Bitcoin (BTC) Price Prediction 2030: $500K or Bust?

Bitcoin price predictions for 2030 range widely, from $150,000 to over $1 million per BTC. Experts like Robert Kiyosaki and Chamath Palihapitiya cite inflation, institutional adoption, and fixed supply as key drivers of long-term bullish price action. This article explores whether Bitcoin could realistically reach $500,000 by 2030 and what factors will influence that journey.

Introduction: Why 2030 Is a Pivotal Year for Bitcoin

The Evolution of Bitcoin’s Market Role

Since its creation in 2009, Bitcoin has evolved from a niche digital asset to a globally recognized financial instrument. Bitcoin is the first decentralized cryptocurrency and is increasingly considered a long-term store of value. Institutional interest, utility enhancements, and market perception are reshaping Bitcoin’s role in the modern economy.

Why Long-Term Forecasts Matter

Forecasting Bitcoin’s future value helps investors and policymakers plan for monetary shifts. With global inflation, economic instability, and rising interest in crypto, long-term Bitcoin price predictions through 2025, 2026, and even 2040 have become essential.

Bitcoin’s Historical Price Movements & Halving Events

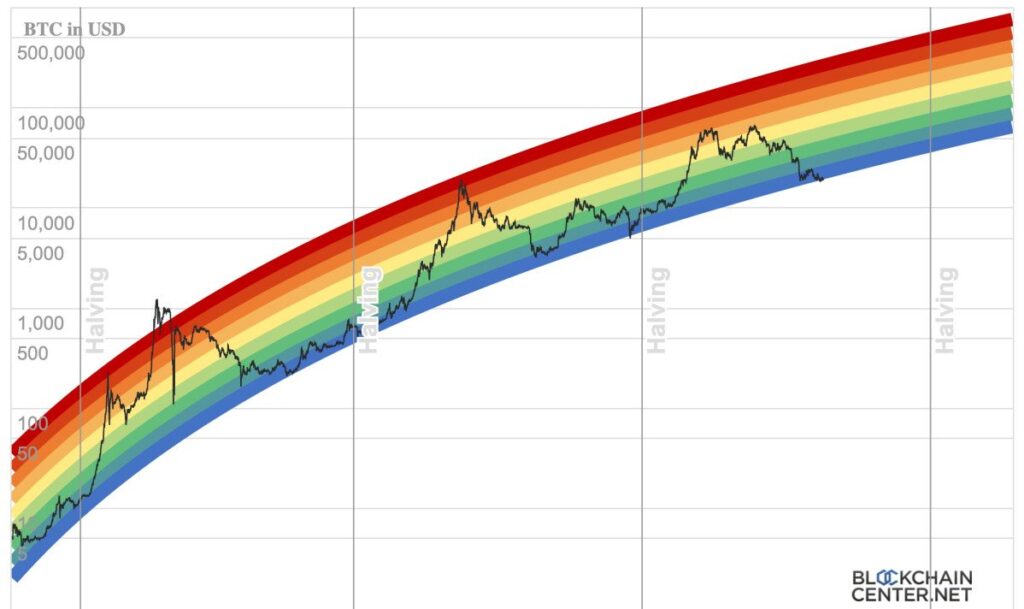

Understanding Bitcoin Halvings and Their Impact

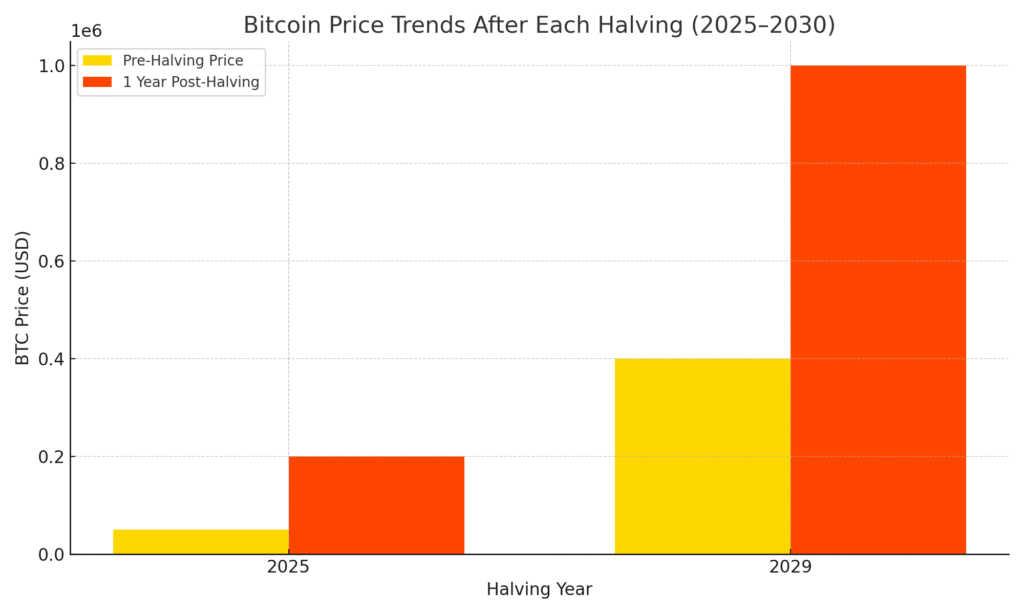

Bitcoin halving occurs approximately every four years, cutting miner rewards in half. Each halving historically leads to price surges as supply drops and demand continues.

Price Trends After Previous Halvings

| Halving Year | Pre-Halving Price | Price One Year Later | Increase |

|---|---|---|---|

| 2012 | $12 | $1,100 | ~9,000% |

| 2016 | $650 | $2,500 | ~285% |

| 2020 | $8,500 | $60,000 | ~605% |

Expert Bitcoin Price Predictions for 2030

- Robert Kiyosaki: Predicts Bitcoin could hit $1 million due to fiat collapse and BTC’s role as a hard asset.

- Hal Finney: Suggested BTC could reach $10 million if it becomes the world’s reserve currency.

- Chamath Palihapitiya: Forecasts $500K by October 2025 and $1 million by 2040.

- Fidelity: Projects a $1 billion valuation per BTC by 2040 due to mass adoption.

- Peter Brandt: Targets $250K–$500K based on technical charting and market structure.

- Max Keiser: Expects $500K+ fueled by institutional FOMO and ETF growth.

Will Bitcoin Reach $500,000 by 2030?

Arguments Supporting a $500K Price Target

- Scarcity from the 21 million coin limit

- Global inflation and fiat currency devaluation

- Increased adoption by governments and institutions

- Lightning Network scalability and Layer 2 upgrades

Counterarguments

- Regulatory risk may suppress growth

- Extreme volatility could scare investors

- Unknown technological vulnerabilities

Is It Viable?

For Bitcoin to hit $500K, its market cap must exceed $9.5 trillion — roughly the current size of the gold market. If adoption trends continue, many analysts believe this is achievable.

Factors That Could Influence Bitcoin’s 2030 Price

Supply and Demand Dynamics

Bitcoin’s fixed supply and increasing demand — especially in emerging markets — could place upward pressure on its price.

Global Inflation and Fiat Currency Devaluation

Bitcoin is often considered a hedge against inflation. As fiat currencies lose value, BTC becomes more attractive as a store of value.

Regulatory Landscape

Positive regulation may encourage adoption. Harsh bans or overregulation may lead to price suppression or market shifts.

Institutional Adoption & Bitcoin ETFs

The rise of spot Bitcoin exchange-traded funds makes BTC accessible to pension funds and institutional portfolios, increasing buying pressure and reducing volatility.

Macroeconomic & Geopolitical Events

From bank collapses to debt crises, global uncertainty has historically driven capital into Bitcoin.

Bitcoin ETF Approvals: A Catalyst for Growth

2024 ETF Approval Overview

In Q1 2024, the SEC approved several spot Bitcoin ETFs. This milestone opened the doors for institutional capital to flow into Bitcoin directly.

How ETFs Support Long-Term Price Increases

- Improve liquidity and legitimacy

- Enable hands-free Bitcoin investment

- Attract conservative and risk-averse investors

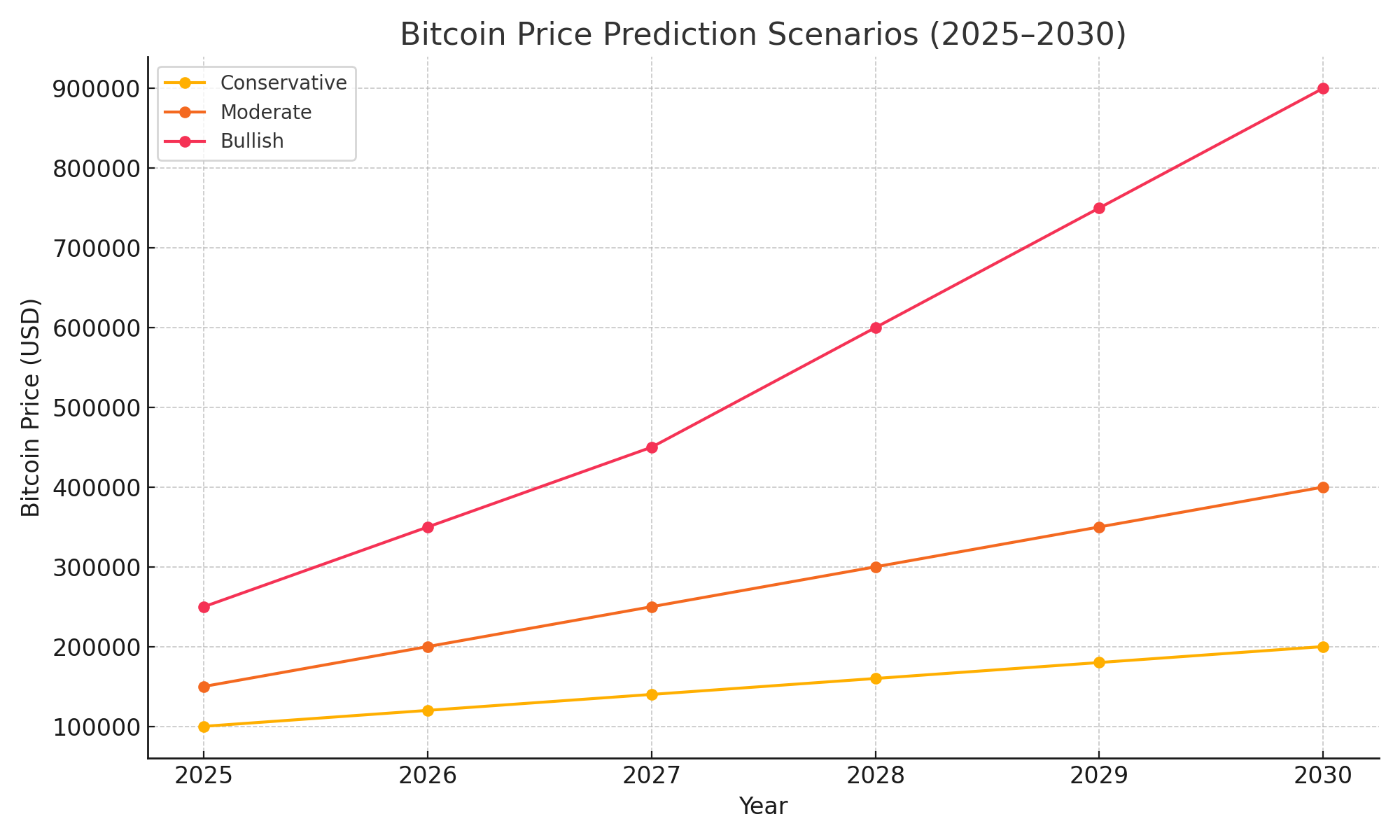

Bitcoin Price Prediction Scenarios for 2030

- Conservative Case: $150K–$250K

BTC gains steadily with stable regulation and moderate retail interest. - Moderate Bullish Case: $250K–$500K

Strong ETF adoption, macro pressure, and rising demand push BTC toward $500K. - Moonshot Scenario: $500K–$1M+

If Bitcoin replaces fiat in major economies, it could become the global monetary standard.

ZenCryptoLabs: Your Partner for Bitcoin Forecasting

Why ZenCryptoLabs?

- Predictive models for short- and long-term Bitcoin price forecasts

- Weekly reports with price analysis, sentiment data, and ETF news

- Tools for both beginners and pros to track market movement

- Transparent, data-backed insights with no hype

📈 Visit ZenCryptoLabs.com for real-time Bitcoin price predictions, analytics, and crypto market tools.

🖼️ [Insert Logo or Screenshot of ZenCryptoLabs Dashboard]

FAQ: Bitcoin Price in 2030

Conclusion: $500K Bitcoin — Dream or Destiny?

While no prediction is certain, Bitcoin’s fundamentals, history, and momentum suggest that $500K by 2030 isn’t out of reach. As Bitcoin cements itself as a global store of value, staying informed with trusted insights — like those from ZenCryptoLabs — is key to navigating the road ahead.